Time is truly money for a business owner. Within a day, you only have so much to give to grow your business. Whether it is fulfilling a last minute order, drawing up a proposal or travelling between business meetings, you need all the help you can get to save time to focus on your business goals. Here are eight ways you can reduce the hidden time and costs associated with managing your finances to create a sustainable business:

Improve Visibility Over Supplier Bills

In the competitive business space, every minute counts. Discover ways to reduce manual data entry by automatically extracting key information from emails or pdf bills from suppliers and by auto-populating bills.

Businesses that use digital accounting software like Xero stand to save an average of 25 percent when it comes to time spent entering bill information. This means 2.5 hours more for you to focus on the more important aspects of your business.

Reduce Hidden Costs, Stop Bleeding Cash

Are employee expense submissions eating up precious time and costs? It’s important to ensure that employees file their claims correctly and promptly.

Digital methods allow employees to take a snap of their receipt and automatically scan the details to fill out a claim. This helps employees create more timely expense submissions and reduces the amount of errors and rework required. Furthermore, apps like Xero include a host of helpful features, including multi-currency, mobile notifications, and rich analytics to streamline the process even further.

Seamless Data Collection And Capture – No More Human Errors

Save time by automating administrative tasks such as financial document collection and data entry. Accounting practices can be digitalised so you can spend more time analysing data instead of chasing clients and inputting data yourself. What’s more, you can overcome the disruptions caused by human errors, freeing up your time and giving yourself peace of mind to run your business.

You can take advantage of programmes under the Accountancy Industry Digital Plan (AIDP) to accelerate your digitalisation plans. More businesses in more sectors are now covered under the new SMEs Go Digital Programme, thanks to the new Budget 2020.

Approve Transactions Quickly Based On Bank Rules

Bank reconciliation is one of the greatest hassles of running a business. Hence, it’s best to streamline the process with automation. Tools like Xero automatically learn and approve transaction matches based on bank rules the user has applied. This eliminates the hassle of manually approving transactions.

Accelerate Invoicing And Payment Reminders With AI

Late payments is one of the biggest issues facing businesses today. According to Xero’s data, a third of invoices from Singapore businesses were paid over 31 days late last year. In total, businesses were owed a staggering S$10.3 billion in late payments in 2019.

With technologies like machine-learning and automation, you are able to create and manage invoices faster than ever before. Platforms like Xero are also integrated with the nationwide e-invoicing framework, which standardises and accelerates the invoicing process among businesses.

Manage Payroll And HR Effortlessly

Payroll is another aspect that can be streamlined. You can reduce the time needed to pay staff, manage talent and handle CPF contributions. Our new payroll employee bulk upload feature lets users drag and drop a spreadsheet of all employees in one go. This saves abundant amounts of time (about ten minutes per employee) and set-up errors.

File Taxes Efficiently And Accurately

Doing your business taxes can take up a bulk of your time. This is especially problematic when the process is entirely manual. Consolidating different Excel spreadsheets, physical documents and other things like receipts can be difficult. Plus, this lack of visibility will affect the speed and accuracy at which you file your taxes.

You have the option of optimising the process by digitalising it. Business and accounting platforms are programmed with the latest tax regulations, so that you don’t have to worry about keeping up. Meanwhile, they give you complete visibility over your accounts. This way, you are can fulfil your tax obligations quickly and effectively.

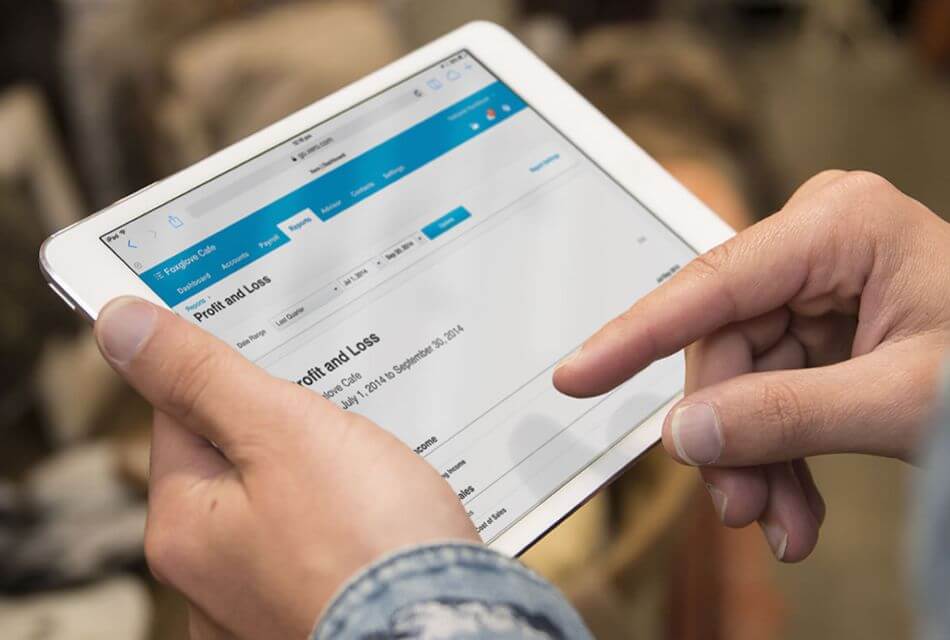

Access Your Business Ins And Outs Anytime, Anywhere, On Any Device

As a business owner, you are constantly on the go. But being out of the office doesn’t mean you have to be out of touch with your business. Super apps like Xero give you access to your business and accounting operations while you’re out liaising with clients, closing important deals or meeting a potential hire. You can stay connected to your business with intuitive dashboards providing all the information you need in one screen – on any device. This means you can have peace of mind and total control of your accounting wherever you are and on your schedule.